We would like to hear your feedback! To participate, please click here

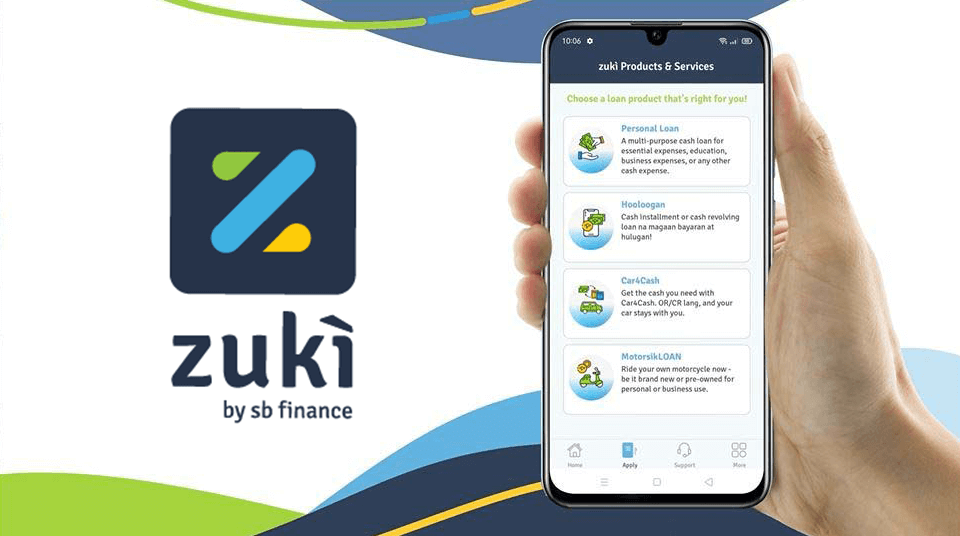

Consider our Personal Loan as your safety net for your financial needs, whether it’s for education, business, travel, or debt consolidation.

Personal Loan : Requirements & Eligibility

Documentary Requirements

- Prior application via the zukì mobile app, prepare

the scanned copies of the following documents

below. - Files can be in jpeg, pdf, or png format. Size of the

digital images and files should not exceed 5mb

Note: Additional documents may be required to process the loan.

Eligibility

At least 21 years old at the time of application, but not more than 65 years old upon loan maturity.

-

- Must be a Filipino Citizen

- Must have an office or residence landline

Income documents, any of the following:

- Latest one (1) month payslip

- Certificate of Employment and Compensation – issued within the last six (6) months

- Latest ITR

- Credit Card

- Credit Card must be active for at least 12 months

- Credit Limit should be at least PhP 45,000 for those residing in Metro Manila and PhP 36,000 for those residing outside Metro Manila

- Income requirements

- For Metro Manila: PhP15,000

- For outside Metro Manila: PhP12,000

- 1 valid primary government ID

- Latest COEC issued within the last 3 months showing salary, employment tenure (or start date) and end date (if applicable) or latest Remote Employment Contract with less than 1 year, supplemented by proof such as COE that shows more than 1 year employment in the current company

- 3-months pay slip or 3-month transaction/bank history

- A valid email address using company domain (max of 3, 1 per each employer)

- Latest one (1) year Audited Financial Statement

(AFS) with at least the previous year’s comparative financials - SEC/DTI Certificate of Registration

- Business permit/Mayor’s permit

- Latest three (3) months bank statements

- List of three (3) trade references with contact details

- At least one (1) supplier and one (1) customer

- Latest GIS (if corporation)

- For Self-Employed or Self-Employed Professionals, borrower must be the owner or a majority owner with at least 40% stake AND the business should have been operating profitably for at least 2 years with at least 1 trade reference.

- Minimum gross monthly income of PhP60,000

Note: Additional documents may be required to process the loan.

a) 1 valid government ID of the beneficiary

b) Identity of the OFW (Working Visa and Passport of the OFW) - with signature specimen

c) Proof of remittance: Consecutive six (6) months of proof of remittance from the nominated OFW within the past twelve (12) months

- Remittance slips – Sender’s or Receiver’s copy, indicating the name of the OFW and the beneficiary

d) Proof of relationship with the OFW

For Parents: PSA Birth Certificate of the OFW, indicating the name of the borrowing parent; OR

For Children: PSA Birth Certificate of the borrowing offspring, indicating the name of the OFW; OR

For Spouse: Marriage Certificate

Don’t put your plans on hold

Our Personal loan is specifically tailored to make your dreams come true

Easy application process options

Apply online via mobile app, online form, or at any Security Bank branch, or through our agent partners

Collateral-free loan

High loan amount of up to PhP3 Million without any collateral or guarantor

No PDCs needed

We don't require post-dated checks as mode of payment for your loan

| Loanable Amount | PhP 30,000 to PhP 3 Million |

| Payment Terms | 12, 18, 24, 36 months |

| Monthly Add-On Rate* | 2% |

| Estimated APR at 36 months | 39.43% |

| Processing Fee | PhP 5,000 |

| Notarial Fee (For P100,000 loan and up) | PhP 300.00 |

*Estimated APR at 36 months is 39.43%

*Rates shown are indicative only and may change upon approval.

*SB Finance will never ask you to pay a facilitation fee for your application. If you receive a call, SMS, or email asking you to pay a facilitation fee, do not engage. Immediately report the incident to our Customer Service hotline at (+632) 8887-9188 or email us at [email protected].

How to Pay

| Channels | Min/Max Amount Accepted |

|---|---|

| Security Bank Branches (Over-the-Counter or ATMs) Operating Hours: Bank hours | No Limitation |

| Security Bank Automatic Debit Arrangement Operating Hours: 9AM – 9PM | No Limitation |

| Security Bank Online via this link (via enrollment) Operating Hours: 24/7 | No Limitation |

| Security Bank Mobile Banker (via enrollment) Operating Hours:: 24/7 | No Limitation |

Reminder:

Please adhere to your chosen loan payment method as specified in your signed loan documents. Note that payment transactions made on non-business days will be considered as the next business day's transactions, and will be posted on the next business day after the transaction date. All other transactions will be posted on the next business day.

For example, payments made on Saturday or Sunday will be considered as Monday’s transactions, which will be posted the following day, Tuesday. Similarly, if Monday is a holiday, the transactions on this day will be considered as Tuesday’s transactions, and will be posted on Wednesday. If Monday is a regular business day, transactions will be posted on Tuesday.

Additionally, for post-dated checks or automatic debit arrangements (ADA), kindly ensure that your linked account is adequately funded on or before the due date. If closed, you may opt to pay using other payment channels via bills payment.

| Channels | Min/Max Amount Accepted |

|---|---|

GCash Operating Hours: 24/7 | The GCash transfer/payment limit varies based on your account verification status. |

Payment transactions will be posted within 3 business days.

| Channels | Min/Max Amount Accepted |

|---|---|

CVM Pawnshop Operating Hours: 8AM – 5PM Monday – Sunday | Max P50,000 per transaction |

Gaisano Malls Operating Hours: Mall Hours | Max P50,000 per transaction |

7 Eleven Operating Hours: 24/7 | P10,000.00 Kiosk Machine P50,000.00 using the CliQQ mobile app |

Reminder:

Please adhere to your chosen loan payment method as specified in your signed loan documents. Note that payment transactions made on non-business days will be considered as the next business day's transactions, and will be posted on the next business day after the transaction date. All other transactions will be posted on the next business day.

For example, payments made on Saturday or Sunday will be considered as Monday’s transactions, which will be posted the following day, Tuesday. Similarly, if Monday is a holiday, the transactions on this day will be considered as Tuesday’s transactions, and will be posted on Wednesday. If Monday is a regular business day, transactions will be posted on Tuesday.

Additionally, for post-dated checks or automatic debit arrangements (ADA), kindly ensure that your linked account is adequately funded on or before the due date. If closed, you may opt to pay using other payment channels via bills payment.